What Does it Mean to Have an Upside Down Loan?

Taking out a mortgage has become a completely normal practice in homebuying. However, as mortgage buying becomes more routine (and accessible), the real estate market will make prices more competitive (and expensive). This can enhance the value of some real estate but depreciate previously well-regarded property. This can leave homebuyers in a very vulnerable position of owing more money than what the home is worth.

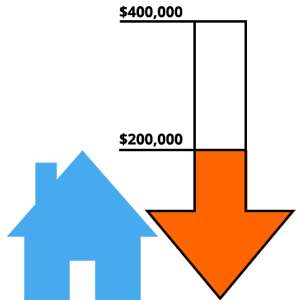

For example, Mary and Joseph take out a $400,000 loan to buy a home. They purchase the home with the loan. The housing market plummets and their home is worth only $200,000. This makes it hard to pay down – or amortize – your loan, especially if you have to sell your house before the market corrects. When this happens, homeowners are saddled with what is called an ‘upside down loan’ or ‘negative equity.’

What is Amortization?

Amortization is the elimination of a loan or debt by paying smaller sums on a regular schedule. These payments cover both the principal loan and the interest accrued over time. Initially, the bulk of the payments go toward paying the interest on the loan.

As time goes on, more and more of the principal is paid. The balance left on the mortgage is then considered when evaluating whether a loan is upside-down.

For example, if Mary and Joseph have paid down their principal plus interest to $200,000, their loan is not considered upside-down. Only when more is owed than the estimated value of an asset is a loan upside-down.

What Can Be Done?

If the house’s value is only half of the loan amount, you should remove yourself from financial difficulty. What to do next depends on how much negative equity you have. If the loan only exceeds the value of an asset (in this case, the mortgage and house respectively by 10-20%), then refinancing and other options may be available.

Voluntary Foreclosure

When a home becomes a bad investment, it makes sense to submit to a voluntary foreclosure. In other words, you decide to ‘walk away’ from a severe financial burden. Rather than being forced to give up your home, you make an informed decision. You default and cease payments on your home, even if you can continue, because the house is a bad investment. When you default, the lender must foreclose on the home.

Doing this is a very dramatic decision. There are long-term downsides to this course of action. Depending on state laws, a lender could pursue a deficiency judgment. This is where a lender seeks to recoup the difference in cost between the debt owed and the foreclosure sale (hence the ‘deficiency’).

Also, securing a future loan may be very hard. By choosing to default, you are ineligible for a Fannie Mae backed loan for up to seven years. While a foreclosure may not ruin your credit score, getting new loans will be more difficult. For example, the interest rate you can get for a car loan will be hurt by the foreclosure for no less than three years. This could also hurt future chances to rent when possible landlords run credit checks.

Alternatives to Voluntary Foreclosure

Instead of choosing to foreclose, you can do a short sale. A short sale is when you sell your house for less money than your loan amount to pay for some of the mortgage. In some cases, lenders will take the deed to underwater or upside down properties.

Recently, Fannie Mae and Freddie Mac have allowed some homeowners to do this. In the process, this cancels any leftover debt under the Mortgage Release and Standard Deed in Lieu of Foreclosure programs. Also, under the government’s Making Homes Affordable programs, you have chances to refinance and get lower interest rates on current home loans.

FastHouseSale.org also provides options if you need to avoid foreclosure. Contact our team now to get the answers you need fast.